Existing Client? Login

Article

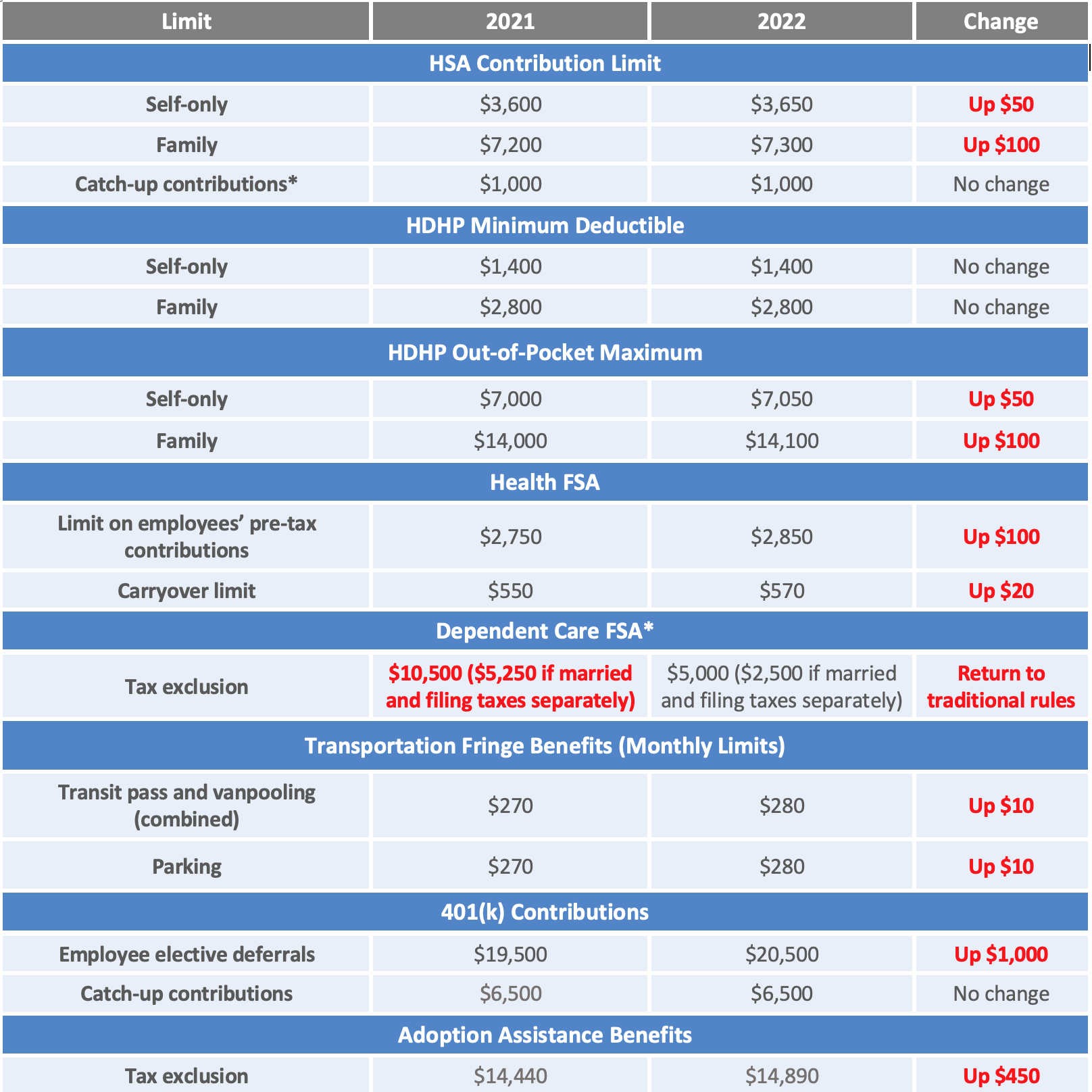

Employee Benefit Plan Limits for 2022

Many benefit plan limits have changed for the new calendar year. Here are some limits to review for 2022:

401(k) Limits

- Pre-tax contributions: $20,500 (up $1,000 from 2021)

- Catch-up contributions: $6,500 (no change from 2021)

Health Savings Account (HSA) Limits

Pre-tax contributions:

- Single coverage: $3,650 (up $50 from 2021)

- Family coverage: $7,300 (up $100 from 2021)

Catch-up contributions: $1,000 (no change from 2021)

High Deductible Health Plan (HDHP) Limits

HDHP minimum deductible

- Single coverage: $1,400 (no change from 2021)

- Family coverage: $2,800 (no change from 2021)

HDHP maximum out-of-pocket costs

- Single coverage: $7,050 (up $50 from 2021)

- Family coverage: $14,100 (up $100 from 2021)

Flexible Spending Account (FSA) Limits

Contributions: $2,850 (up $100 from 2021)

Many employee benefits are subject to annual dollar limits that are periodically updated for inflation by the IRS. The following commonly offered employee benefits are subject to these limits:

- High deductible health plans (HDHPs) and health savings accounts (HSAs);

- Health flexible spending accounts (FSAs);

- 401(k) plans; and

- Transportation fringe benefit plans.

The IRS typically announces the dollar limits that will apply for the next calendar year well before the beginning of that year. This gives employers time to update their plan designs and make sure their plan administration will be consistent with the new limits.

This Compliance Overview includes a chart of the inflation-adjusted limits for 2022. Most of the limits will increase, although some limits remain the same for 2022.

Links and Resources

- Revenue Procedure 2021-25: 2022 limits for HSAs and HDHPs

- IRS Notice 2021-61: 2022 limits for retirement plans

- Revenue Procedure 2021-45: 2022 limits for health FSAs, adoption assistance and transportation fringe benefits

For more information on any of these limits, please contact ThinkTank Insurance Partners today.

Marty Thomas

Marty has spent most of the last 20 years developing software in the marketing space and creating pathways for software systems to talk to each other with high efficiency. He heads our digital marketing efforts as well as oversees any technology implementations for our clients. As a partner, Marty is also responsible for internal systems in which help our team communicates with each other and our clients.